Dialogue on ESG

The ESG Dialogue:

Financing the next wave of Climate Tech

Convergence of innovation, compliance and commercialisation in sustainability

The evolution of ESG ratings and classifications

Tech-driven solutions for sustainable supply chains

Browse Agenda: ESG

Join us as we unfold the journey of the Green Fintech Network's inaugural year at the cutting edge of sustainable finance innovation. This round table will explore the milestones achieved and the collaborative efforts to bolster Switzerland's position in the global market. Join the discussion on the rich and unique Swiss ecosystem, share success stories, address the challenges faced, and chart a course for the future of green digital finance.

Session Objectives:

- To present a comprehensive overview of GFN's evolution, highlighting the strides made in developing a value proposition that resonates globally.

- To unveil the «Green Fintech Map» showcasing how Swiss startups address different steps of the sustainable finance value chain.

- To articulate the unique selling points (USPs) of the Swiss ecosystem and its role in driving forward the global sustainable finance agenda.

- To discuss the practical challenges and learning experiences in funding green fintech ventures.

- To affirm the strategic timing for investing in green fintech, supported by compelling market and policy developments.

- To highlight successful collaborations between green fintechs and financial institutions, serving as case studies for future endeavors.

- To compare and contrast the Swiss green fintech ecosystem with other international hubs, deriving lessons and best practices.

- To provide an outlook on GFN's goals and milestones for the coming year, setting the stage for ongoing engagement and growth.

Watch this space for more information.

}', 13='{type=option, value={id=2, name='Elevating ESG', order=1, label='Elevating ESG'}}', 15='{type=list, value=[{id=170747472278, name='Dr Christoph Gebald'}]}', 16='{type=list, value=[]}', 17='{type=list, value=[]}', 18='{type=option, value={id=9, name='Hall C (Level 2)', order=8, label='Hall C (Level 2)'}}'}, {id=166919172413, createdAt=1715265338188, updatedAt=1737360944208, path='agnd1221-future-shapers-mandating-change-or-changing-mandate-can-eu-regulations-succeed-in-greening-global-supply-chains', name='Future Shapers – Mandating change, or changing mandate: Can EU regulations succeed in greening global supply chains?', 2='{type=string, value=Future Shapers – Mandating change, or changing mandate: Can EU regulations succeed in greening global supply chains?}', 3='{type=string, value=AGND1221}', 4='{type=number, value=1719920100000}', 5='{type=number, value=1719921900000}', 6='{type=option, value={id=3, name='Insights Stage', order=1, label='Insights Stage'}}', 7='{type=string, value=Future Shapers – Mandating change, or changing mandate: Can EU regulations succeed in greening global supply chains? Alexander Stevens, Chief Executive Officer, Greenomy, Cameron Plese, Head of Government Affairs (North America & Europe), Roundtable on Sustainable Palm Oil, Judson Berkey, Managing Director, Chief Sustainability Office, UBS Pamela Mar, Managing Director, Digital Standards Initiative, International Chamber of Commerce }', 8='{type=number, value=1}', 12='{type=string, value=The EU is a global frontrunner in advancing sustainability across multi-market supply chains through regulations such as the CSDDD and EUDR. However, these regulations face criticism for difficulties in interpretation, compliance, and heightened costs for the parties involved. Additionally, countries and sectors are campaigning to ring-fence the impact on their constituents, leading to a dilution of the desired outcomes.

Is there still a case for EU regulation as a prime driver of change? What’s needed to make this a reality?

The evolution of ESG data has been driven by increased demand from a broader range of users, for a variety of purposes and objectives, potentially prioritising different outcomes. Users of ESG data have to contend with identifying relevant, reliable, comparable information from the huge volume of data ‘noise’, from which they can draw insights, to make decisions and be accountable for their actions.

Enterprises are wrestling with onerous disclosure requirements, and provide more granular detail to comply with regulation and meet their diverse stakeholders’ needs. They face greater sanctions for greenwashing or greenhushing. At the same time their stakeholders’ are also assessing their ESG performance using data from sources external to the enterprise.

This discussion will explore the challenges and opportunities of evolving sources of ESG data, and how they are being applied and the potential future developments needed to ensure greater value creation.

The tide of global ESG investments has slowed in recent years, with 2024 marking the first year of net outflows from sustainability-focused equity funds. This trend is driven by accusations of a lack of clarity about whether the invested dollars are truly promoting sustainability; investigations suggest that only slightly more than half of this spending is directed towards sustainable companies. This shift is accompanied by a renewed focus on economic profit, as investors grow weary of the "politicisation of ESG".

Is there still a strong case for ESG or sustainability-focused investment? What works, what doesn’t, and what needs fixing?

This roundtable reflects Elevandi’s commitment to overcoming the barriers to scaling sustainable finance, and build upon conversations at the Point Zero Forum, Singapore FinTech Festival and Japan FinTech Festival on finance climate data.

The recent introduction of the sustainability reporting requirements such as the EU Deforestation Regulation (EUDR) and the Corporate Sustainability Due Diligence Directive (CSDDD) presents a turning point for businesses within the supply chain. While navigating the complexities of supply chain mapping, verification procedures, and implementation costs associated with these regulations can be daunting, they also offer a foundation for gaining a competitive edge. This exclusive roundtable discussion brings together key stakeholders – businesses of all sizes, forward-thinking financial institutions (FIs), and innovative technology providers – to foster collaboration and unlock the full potential of EUDR and CSDDD.

Operating under our Elevating ESG theme, this interactive session goes beyond mere compliance. We'll delve into best practices that not only ensure businesses meet the new regulations, but also help them transform compliance into a competitive advantage. Experts will share insights on efficient supply chain mapping, robust verification procedures, and cost-optimization tactics and available financial instruments. Additionally, the roundtable will explore usage of tech solutions for operational efficiency and competitive advantage.

The envisioned collaboration is intended to extend beyond the roundtable itself. We'll explore the design, development, and deployment of a pilot to gain valuable insights and foster a supportive ecosystem. Collaboration with industry stakeholders, for smoother implementation of these requirements and championing best practices for sustainable supply chain reporting. Through this roundtable, attendees will gain digestible insights and have the opportunity to contribute to the pilot project firsthand.

Attendees who wish to familiarise themselves with the topic may refer to the reference materials below.

- ESG: The Urgency of Action & Why Climate Technology Matters Now

- The Climate Data Roundtable

- Project Savannah: Maximising the Potential of Digital ESG Credentials for MSMEs

Global warming is on track to surpass the 2°C barrier, necessitating the urgent deployment of climate technologies to avert catastrophic consequences. These technologies, currently in early stages with long development cycles, require substantial support to reach maturity. Conventional financing often falls short in supporting mission-driven entrepreneurs who are committed to impact. How can we most effectively accelerate the development and widespread adoption of these crucial climate solutions?

}', 13='{type=option, value={id=2, name='Elevating ESG', order=1, label='Elevating ESG'}}', 15='{type=list, value=[{id=170747472278, name='Dr Christoph Gebald'}, {id=170852417028, name='Dr Laura-Marie Töpfer'}, {id=166926454935, name='Ravi Menon'}]}', 16='{type=list, value=[{id=170729808715, name='Pauline Wray'}]}', 17='{type=list, value=[]}', 18='{type=option, value={id=1, name='Hall A (Level 2)', order=0, label='Hall A (Level 2)'}}'}, {id=170659073941, createdAt=1718712984357, updatedAt=1737360991884, path='agnd1280-funding-the-climate-and-energy-transition', name='Funding the climate and energy transition', 2='{type=string, value=Funding the climate and energy transition}', 3='{type=string, value=AGND1280}', 4='{type=number, value=1719939600000}', 5='{type=number, value=1719942300000}', 6='{type=option, value={id=6, name='Workshop', order=3, label='Workshop'}}', 7='{type=string, value=Funding the climate and energy transition Bénédicte Nolens, Centre Head, Hong Kong Centre, BIS Innovation Hub, Sandra Ro, Chief Executive Officer, Global Blockchain Business Council, Steven Haft, Co-Founder, Ethereum Climate Platform, Gerrit Sindermann, President, Green Fintech Network & Executive Director, Green Digital Finance Alliance (GDFA), Elena Philipova, Director, Sustainable Finance, London Stock Exchange Group, Annabel Nelson, Strategic Advisor, CDP & Co-Labs, Alexandre Kech, Chief Executive Officer, Global Legal Entity Identifier Foundation (GLEIF), Professor Thomas Puschmann, Executive Director, Global Center for Sustainable Digital Finance, Stanford & Zurich University, Emma Joyce, Head of EMEA, GBBC, Vince Turcotte, Business Development Lead, Asia Pacific, Chainlink Labs }', 8='{type=number, value=1}', 12='{type=string, value=This workshop is jointly hosted by Ethereum Climate Fund, Global Blockchain Business Council, and Consensys.

Climate change presents one of the most significant challenges of our time, with potential global damages reaching $23 trillion annually by 2050. Proactive climate action is not only cost-effective—with an estimated $4 trillion needed annually to achieve net-zero emissions by 2050—but also essential to prevent far greater economic and societal costs.

For effective climate action, the participation of the finance industry is vital. Financial institutions play a key role in driving the transition to a more sustainable future through strategic investments in decarbonisation and innovation. Climate Tech firms and infrastructure, as well as the transformation of existing firms and infrastructure, will both require partnership with FIs to create tangible impact. Governments and regulators, through supportive policies, can create the environment which fosters these advancements.

In this workshop, discover the innovative approaches organisations are adopting to create powerful opportunities for collaboration and information networking globally.

This roundtable furthers Elevandi’s exploration of the conditions for developing innovation ecosystems, including at the Japan Fintech Festival and 3i Africa Summit. This roundtable tracks the innovation journey from research laboratory to commercial scale. Considering the lived experience of academics whose research underpin business models that have achieved commercial scale, as well as those of the founders and investors who have brought these models into practice, our discussants will share the factors that shape success, and those that impede them.

Operating under the theme of Elevating ESG, this roundtable will explore the necessary conditions and factors that will smooth the journey of innovators as AI and other technologies enable research and ideas to be developed at an accelerated pace and be tested in new environments with reduced barriers to entry.

Attendees will be invited to participate in a poll on entry, to gauge sentiment around which success factors are deemed critical to success. These factors will be considered by the discussants during the session, and questions will be solicited from the floor.

Attendees who wish to familiarise themselves with the topic may refer to the reference materials below.

- Forging strategic alliances: advancing fintech innovation and narrowing the ai talent gap through industry

The curation of content and speakers was wholly managed by Cardano Foundation and does not reflect the views of the organisers or its staff.

Blockchain technology has the potential to support the efficient achievement of ESG goals by enhancing transparency, traceability and accountability in areas like supply chain and carbon emissions tracking. This workshop will seek to encourage the consideration of blockchain solutions, raising awareness of blockchain’s capabilities and encouraging a wider debate among policymakers and industry veterans about its applicability, potential use cases and proof points so far. It will explore and explain how blockchain technology can be deployed to support the achievement of ESG goals.

The curation of content and speakers was wholly managed by Zurich Insurance and does not reflect the views of the organisers or its staff.

This session will cover:

- The regulations surrounding climate action, providing context on the scenarios in which they apply to foster understanding in a constantly evolving and dynamic environment

- The obstacles that lie in the way of compliance

- Solutions and best practices that will allow organisations to translate these regulations into action

The curation of content and speakers was wholly managed by EY and does not reflect the views of the organisers or its staff.

This interactive session brings practitioners together to delve into the challenges and opportunities of their sustainable finance transformation. We will share insights on successful transformation and explore the drivers and hurdles we face on our sustainable transformation journey. The focus will be threefold: strategy, governance, and data. The conversation will be open to all participants. Together we will discuss:

1. How can purpose be anchored in the core strategy?

2. What does an optimal governance structure to foster change look like?

3. To what extent does access to data and tools play a role in measuring and communicating sustainability performance?

Explore the transformative power of blockchain technology in advancing aid assistance initiatives, showcasing its potential to enhance transparency, traceability, and accountability, driving positive societal and environmental change.

}', 13='{type=option, value={id=2, name='Elevating ESG', order=1, label='Elevating ESG'}}', 15='{type=list, value=[{id=168037514619, name='Candace Kelly'}, {id=168564435065, name='Carmen Hett'}, {id=166919172265, name='Frederik Gregaard'}, {id=170820593185, name='Gabriel Bizama'}]}', 16='{type=list, value=[{id=166926455048, name='Matthias Kröner'}]}', 17='{type=list, value=[]}', 18='{type=option, value={id=9, name='Hall C (Level 2)', order=8, label='Hall C (Level 2)'}}'}, {id=166919172456, createdAt=1715265368563, updatedAt=1737361055134, path='agnd1147-laying-foundations-for-scalable-markets-in-trusted-and-granular-data-for-green-reporting', name='Laying foundations for scalable markets in trusted and granular data for green reporting ', 2='{type=string, value=Laying foundations for scalable markets in trusted and granular data for green reporting }', 3='{type=string, value=AGND1147}', 4='{type=number, value=1720020600000}', 5='{type=number, value=1720026000000}', 6='{type=option, value={id=4, name='Roundtable', order=2, label='Roundtable'}}', 7='{type=string, value=Laying foundations for scalable markets in trusted and granular data for green reporting Alexandre Kech, Chief Executive Officer, Global Legal Entity Identifier Foundation (GLEIF), Alicia Montoya, Head Research Commercialisation, Swiss Re, Dr Andre Kudra, Chief Information Officer, esatus AG, Esther An, Chief Sustainability Officer, City Developments Limited, Jo Gilbert, Technical Director, Connected Manufacturing Lead, GSMA, Ken Forster, Executive Director, Momenta, Lionel Wong, Deputy Director & Head, Green FinTech Office, Monetary Authority of Singapore, Martin Rauchenwald, Global Head of Financial Services, Managing Partner, Arthur D. Little, Pepijn Rijvers, Chief Product & Technology Officer, World Business Council for Sustainable Development, Robert Heinze, Director Technology & Innovation Management , Giesecke+Devrient (G+D) Ivan Mortimer-Schutts, Financial & Digital Markets Advisor, Dataswyft, Sophia Hasnain, Chief Executive Officer, Linked Things }', 8='{type=number, value=1}', 12='{type=string, value=This roundtable furthers Elevandi’s focus on overcoming the limiting factors preventing scaling of practices serving the Sustainable Development Goals. The 2023 Point Zero Forum considered the needs for interoperability, access and verification to track and finance net zero ambitions, which deepened into an examination of Project Savannah, a global initiative by UNDP, MAS, and GLEIF, at the Singapore Fintech Festival. The Japan Fintech Festival continued this in considering the value of a global common for climate data.

Operating under the theme of Elevating ESG, this roundtable brings together the right stakeholders to 1) share progress, insights and challenges; 2) specify the root cause of poor data quality hindering reporting efforts; and 3) shape a proposal for trusted, scalable market arrangements to mobilise granular, machine-issued data for ESG indicators and financial market innovations. Attaining granularity in data collection and consistency in reporting can drastically reduce the cost of assuring the integrity of disclosed ESG indicators, increasing information usability for strategic decision-making, financial products and data market while reducing the impeding reputation risk that arises from opaque reporting.

Attendees who wish to familiarise themselves with the topic may refer to the reference materials below.

- How to build trust in ESG data and disclosures

- Reference Materials for "Laying foundations for scalable markets in trusted and granular data for green reporting"

For lawmakers and standard setters, climate and nature are often presented as two separate topics. In this session, we will highlight how companies have been bridging both topics strategically and through technology to drive a holistic environmental sustainability strategy. Leading corporates, standard setters and green fintechs will share the stage to provide insights to participants over how to take action.

}', 13='{type=option, value={id=2, name='Elevating ESG', order=1, label='Elevating ESG'}}', 15='{type=list, value=[{id=170650133622, name='Aiko Yamashita'}, {id=169638337391, name='Gerrit Sindermann'}, {id=170634159723, name='Gwen Jettain'}, {id=171416866564, name='Jamie Batho'}, {id=171223705629, name='Dr Michael Gloor'}, {id=170747472794, name='Paula Palermo'}, {id=170634159911, name='Peter Paul van de Wijs'}, {id=171221493412, name='Richard Probst'}, {id=171223705709, name='Virginia Castellucci'}, {id=171636361353, name='Linnette Price'}]}', 16='{type=list, value=[]}', 17='{type=list, value=[]}', 18='{type=option, value={id=10, name='Workshop Room 3 (Level 3)', order=9, label='Workshop Room 3 (Level 3)'}}'}, {id=170937858401, createdAt=1718954238089, updatedAt=1737361071776, path='agnd1198-reimagining-aid-assistance-the-case-for-the-creation-of-a-un-digital-wallet-with-embedded-identity-management', name='Reimagining Aid Assistance: The case for the creation of a UN Digital Wallet with embedded identity management', 2='{type=string, value=Reimagining Aid Assistance: The case for the creation of a UN Digital Wallet with embedded identity management}', 3='{type=string, value=AGND1198}', 4='{type=number, value=1720026000000}', 5='{type=number, value=1720027800000}', 6='{type=option, value={id=6, name='Workshop', order=3, label='Workshop'}}', 7='{type=string, value=Reimagining Aid Assistance: The case for the creation of a UN Digital Wallet with embedded identity management Carmen Hett, Corporate Treasurer, United Nations High Commissioner for Refugees (UNHCR), Gabriel Bizama, Researcher, University of Bern and Advisor, DCM Systems, Min Lin, General Manager, Vibrant, Stellar Development Foundation Mike Alonso, Head of Tokenisation, Bank for International Settlements }', 8='{type=number, value=1}', 12='{type=string, value=This workshop explores the transformative potential of digital technologies, specifically blockchain, in improving aid distribution to forcibly displaced individuals and refugees. We will address current challenges, showcase successful implementations, and envision future advancements to promote inclusive solutions for all .

An appeal to policymakers, bankers, fintech partners, government institutions, and investors to join us in this critical initiative, providing support and collaboration to fully realise the potential of the UN digital wallet.

Roundtable

Roundtable Room 2 (Level 2)

Elevating ESG

Insights Stage

Hall C (Level 2)

Elevating ESG

Insights Stage

Hall C (Level 2)

Elevating ESG

Insights Stage

Hall C (Level 2)

Elevating ESG

Insights Stage

Hall C (Level 2)

Elevating ESG

Roundtable

Roundtable Room 2 (Level 2)

Elevating ESG

Forum Stage

Hall A (Level 2)

Elevating ESG

Workshop

Workshop Room 3 (Level 3)

Elevating ESG

Roundtable

Roundtable Room 3 (Level 3)

Elevating ESG

Workshop

Workshop Room 2 (Level 3)

Elevating ESG

Workshop

Workshop Room 3 (Level 3)

Elevating ESG

Workshop

Workshop Room 1 (Level 3)

Elevating ESG

Insights Stage

Hall C (Level 2)

Elevating ESG

Roundtable

Roundtable Room 1 (Level 2)

Elevating ESG

Workshop

Workshop Room 3 (Level 3)

Elevating ESG

Workshop

Workshop Room 2 (Level 3)

Elevating ESG

"There is more to be done in combining policymaking, private sector and public sector involvement, and that comes through discussions such as the one we can have here."

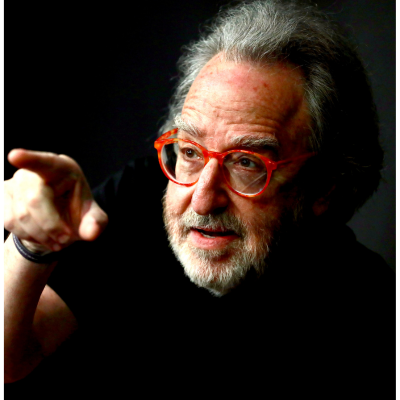

Patrick Odier

Chairman of Building Bridges, President of Swiss Sustainable Finance

"The topics that are chosen for discussion, are things that will be done in the future, and thats very important to us as policymakers because it helps us keep our eyes on what there is to come, and to prepare ourselves for that future."

Pauline Wray

Head of New Ventures, Stealth Startup & Member of the Board of Advisors, Viridios Capital,

"There is more to be done in combining policymaking, private sector and public sector involvement, and that comes through discussions such as the one we can have here."

Patrick Odier

Chairman of Building Bridges, President of Swiss Sustainable Finance

"The topics that are chosen for discussion, are things that will be done in the future, and thats very important to us as policymakers because it helps us keep our eyes on what there is to come, and to prepare ourselves for that future."

Pauline Wray

Head of New Ventures, Stealth Startup & Member of the Board of Advisors, Viridios Capital,

.png)